san antonio property tax rate 2021

The good news is that for taxing purposes property tax values in the state of Texas can only be increased by 10 each year. San Antonio could cut its property tax rate next year based on the citys budget expectations and a.

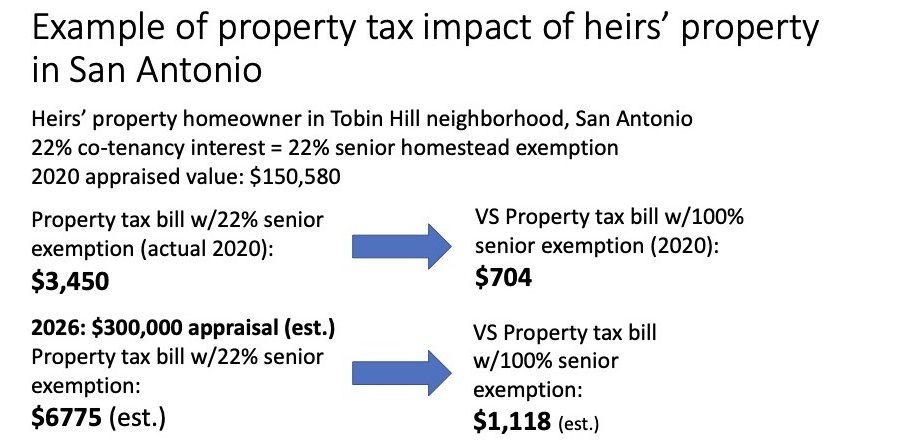

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Did South Dakota v.

. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Submit a report online here or call the toll-free hotline at 18002325454. Aerial view of the Stone Oak area Friday May 20 2016.

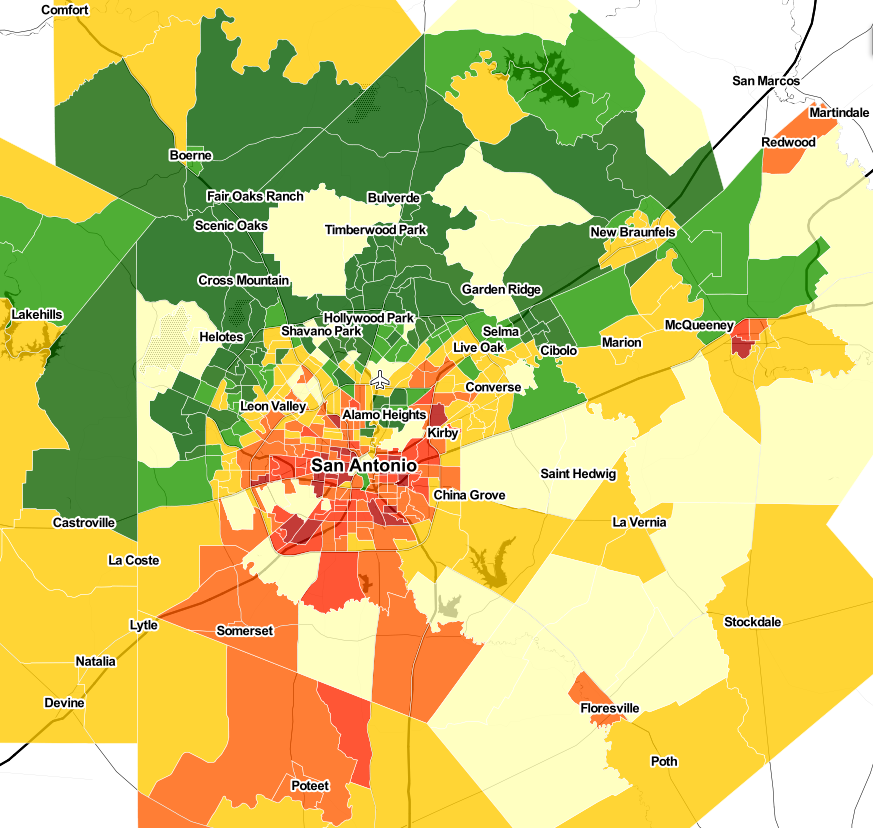

The minimum combined 2021 sales tax rate for san antonio texas is. Monday-Friday 800 am - 445 pm. China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest rate in the area.

Table of property tax rate information in Bexar County. Maintenance Operations MO and Debt Service. 2020 Official Tax Rates Exemptions.

The County sales tax rate is. The current total local sales tax rate in San Antonio TX is 8250. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Monday-Friday 800 am - 445 pm. 2021 Official Tax Rates. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Box 839950 San Antonio TX 78283. Texas has recent rate changes Thu Jul 01 2021. 2021 NNR tax rate.

The minimum combined 2022 sales tax rate for San Antonio Texas is. Setting tax rates appraising property worth and then receiving the tax. Truth in Taxation Summary PDF.

Multiply that by 240000 and you come up with a tax bill of 569617 per year. This city can afford to give more back to our homeowners in this town through a property homestead exemption Perry said noting that the city saw an increase of 20 million in property taxes from 2020 to 2021. The Texas sales tax rate is currently.

That means that for a home with an appraised value of 300000 roughly the median value in San Antonio 20 or 60000 would be exempt making the appraised value 240000 and saving the homeowner about 174. This is the total of state county and city sales tax rates. Box 839950 San Antonio TX 78283.

Bexar County collects on average 212 of a propertys assessed fair market value as property tax. In a city that has the statewide average property tax rate of 18 that homes annual bill would increase from 1800 to 1980. The Texas sales tax rate is currently.

The San Antonio sales tax rate is. Hes seen a 42 percent increase in his property value over the last five years. In San Antonio.

The texas sales tax rate is currently. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Each unit then is given the tax it levied.

San antonio in texas has a tax rate of 825 for 2021 this includes the texas sales tax rate of 625 and local sales tax rates in san antonio totaling 2. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. The property tax rate for the City of San Antonio consists of two components.

1000 City of San Antonio. What is the sales tax rate in San Antonio Texas. The property tax rate for the City of San Antonio consists of two components.

Homestead tax exemptions 100 disabled veterans pay no property tax in the state of Texas. Comptroller of the Treasury Jason E. Overall there are three phases to real estate taxation namely.

Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of. The budget includes a tiny cut in the countys property tax rate a. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

The third pre-filed bill concerning property taxes is HB 529 which would reduce the 10 limit on homestead appraisal increases to 25. For a house valued at 100000 a 10 increase in value would be 110000. Bexar Countys current tax rate is 0276331 per 100 of valuation and the road and flood tax is 0023668 per 100 of valuation.

2021 Official Tax Rates Exemptions Name Code Tax Rate 100 Homestead 65 and Older Disabled. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

14 2021 454 pm. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. 2021 Official Tax Rates.

Taxing entities include San Antonio county governments and a number. San Antonio TX 78205 Phone. They are calculated based on the total property value and total revenue need.

2021 Official Tax Rates Exemptions. Public Sale of Property PDF. Depending on the zipcode the sales tax rate of san antonio may vary f How 2016 sales taxes are calculated in san antonio.

On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. To avoid an election the city would have no choice but to reduce the citys portion of the property tax rate. The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns.

Marriott san antonio rivercenter san antonio texas taad website. 2020 Official Tax Rates. San Antonio As property values continue to grow the City of San Antonio may have to cut its property tax rate to avoid.

RATES PROPERTY TAX GREATER AUSTIN SAN ANTONIO 2021. Thats nearly 13 lower than San Antonios total property tax rate. Wayfair Inc affect Texas.

If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1. 2021 Official Tax Rates. The property tax rate for the City of San Antonio.

These two tax rate components together provide for a total. 48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties. Jessica Phelps San Antonio Express-News.

0250 san antonio atd advanced transportation district. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. San Antonio TX 78207.

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. San Antonio TX 78207.

Sky High Property Appraisals Could Prompt A Higher Homestead Exemption For Sa Homeowners

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

County Commissioners Vote To Decrease Property Tax Rate In 2022

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Bexar County Commissioners Approve Symbolic Property Tax Cut

Tax Rates Bexar County Tx Official Website

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

San Antonio Real Estate Market Stats Trends For 2022

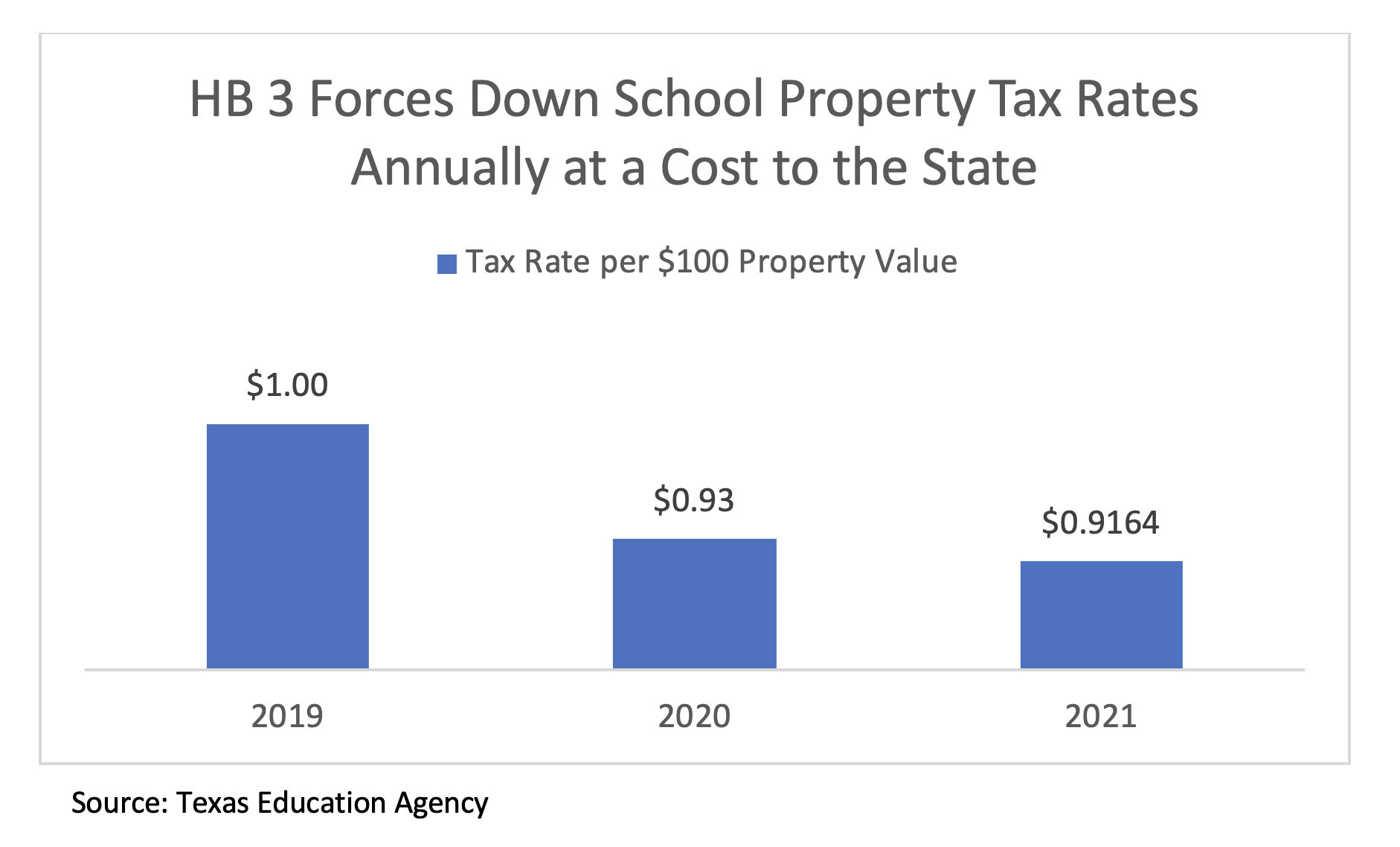

A New Division In School Finance Every Texan

Bexar County Cuts Its Property Tax Rate A Very Little Bit

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Bexar County Property Owners Have Until 5 P M Today To File Their Property Tax Appeals San Antonio News San Antonio San Antonio Current

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket